Dynamic Asset Allocation Strategies Based on Volatility, Unexpected Volatility and Financial Turbulence | Semantic Scholar

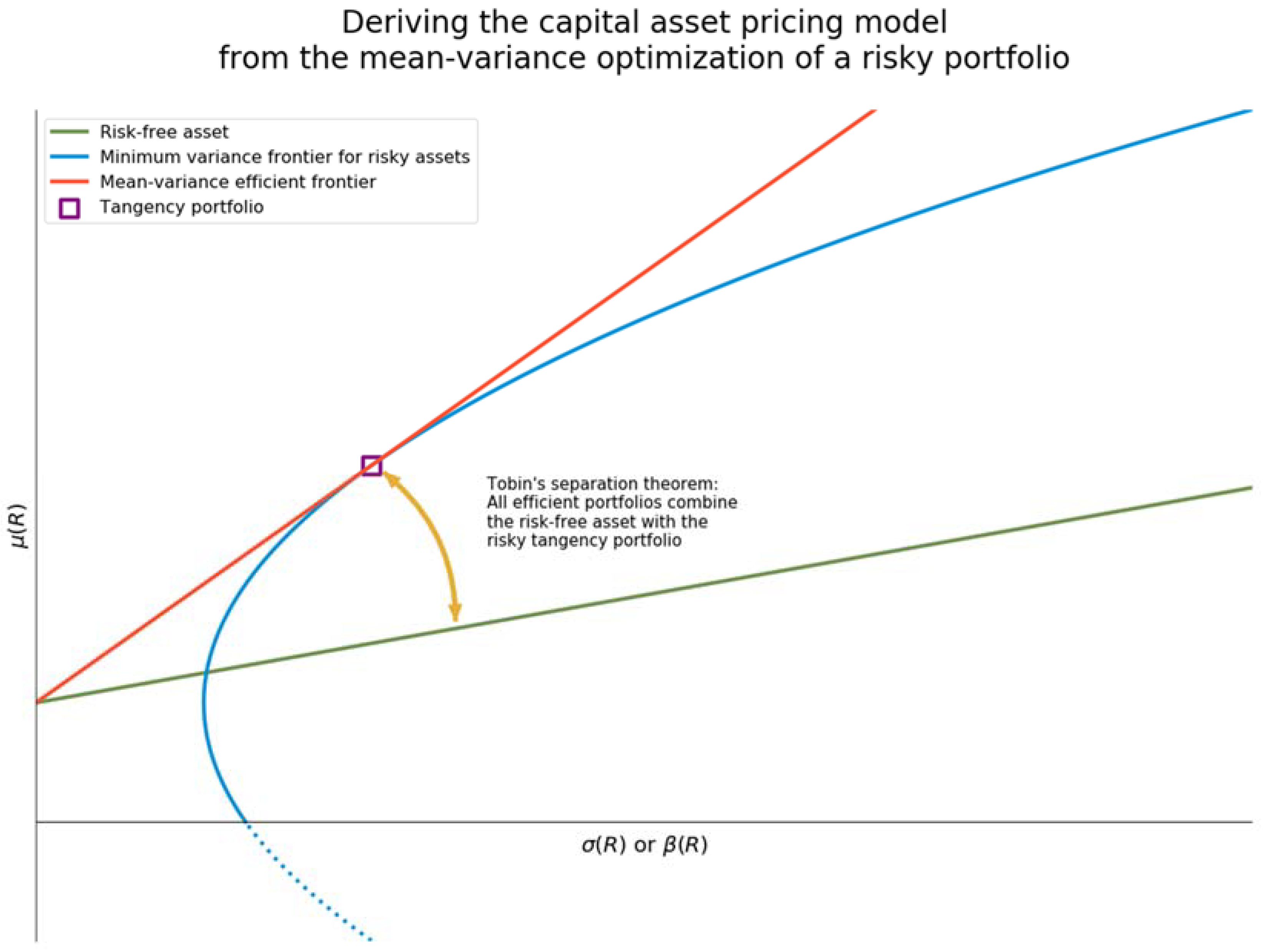

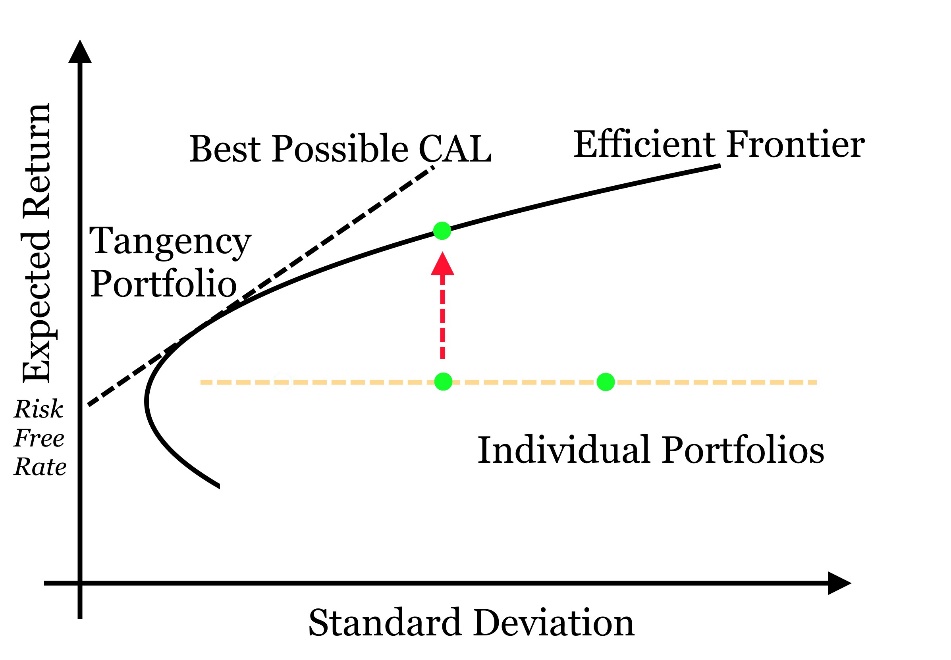

Chapter 8 Risk-Aversion, Capital Asset Allocation, and Markowitz Portfolio- Selection Model 1 By Cheng Few Lee Joseph Finnerty John Lee Alice C Lee Donald. - ppt download

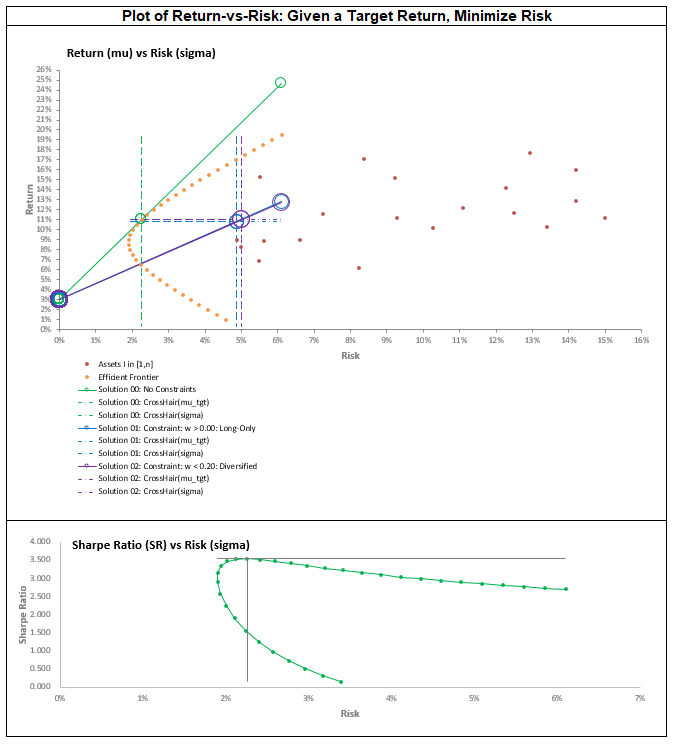

Economics 487 Homework #4 Solution Key Portfolio Calculations and the Markowitz Algorithm A. Excel Exercises: (10 points) 1. Dow

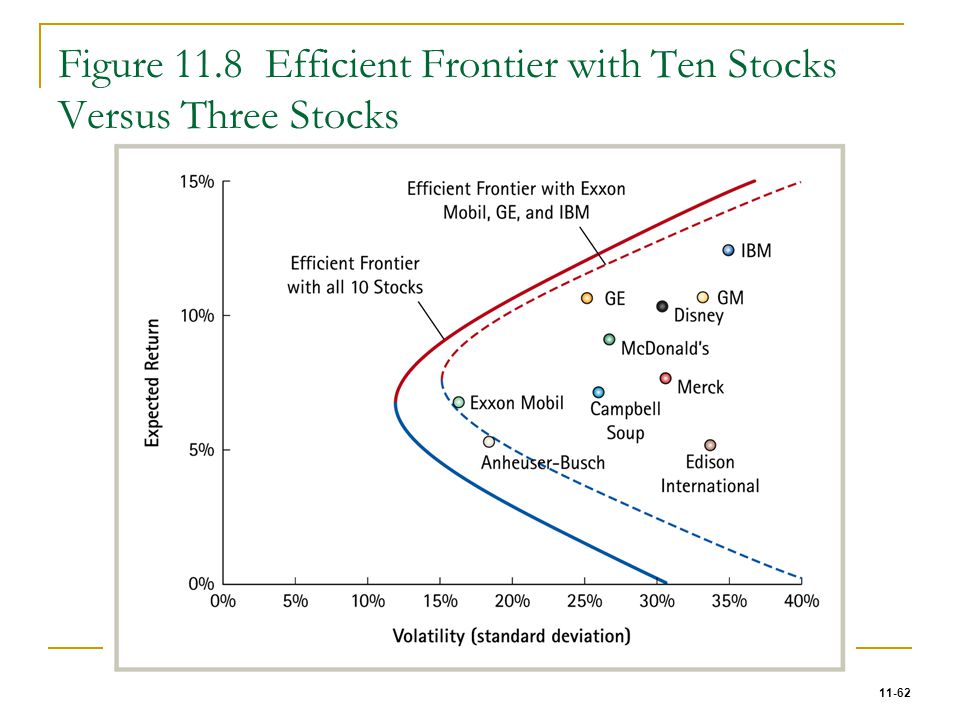

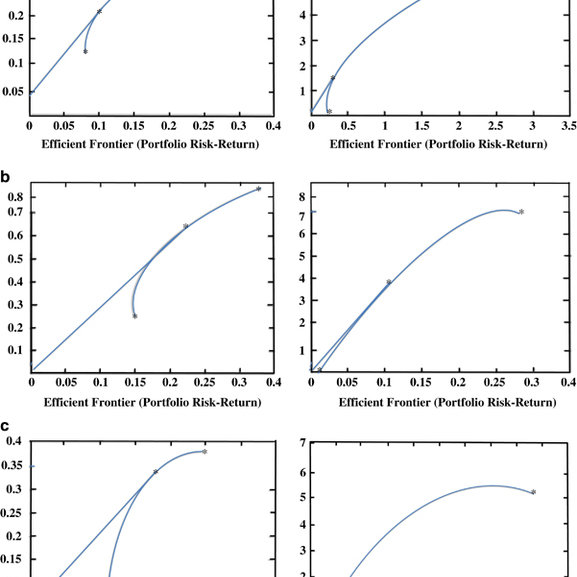

Efficient frontiers without short sales (on the left) and with short... | Download Scientific Diagram

Crystallization Propensity of Amorphous Pharmaceuticals: Kinetics and Thermodynamics | Molecular Pharmaceutics

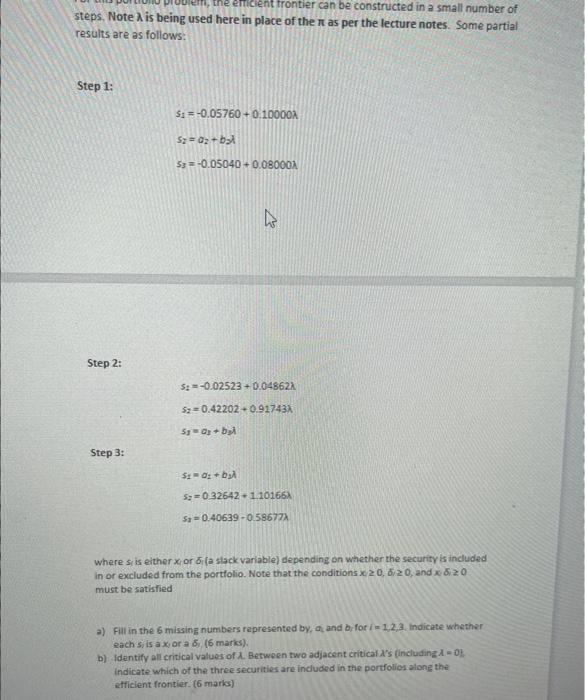

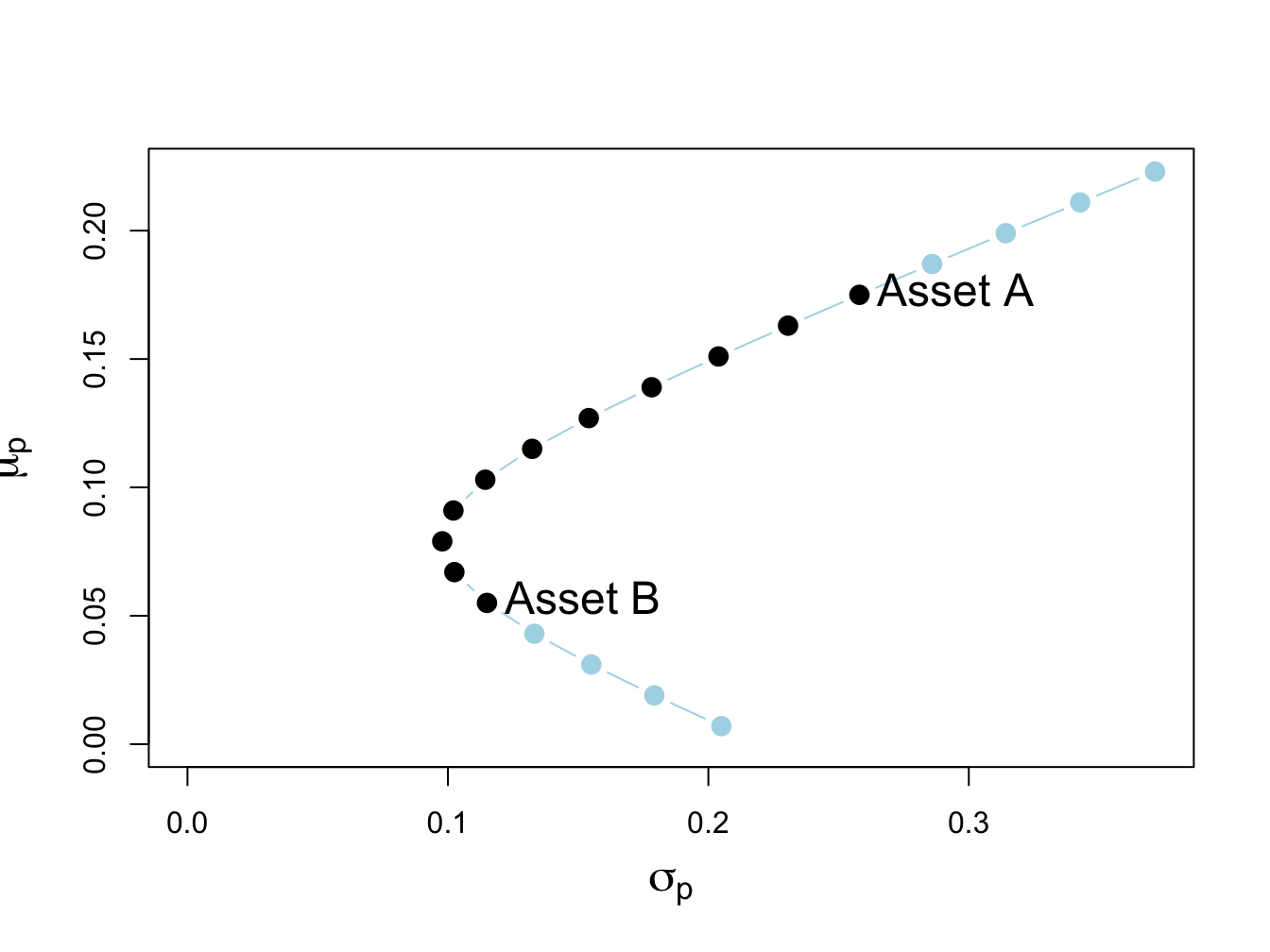

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

technical analysis - What are the primary investment strategies people use and why do they use them? - Personal Finance & Money Stack Exchange

Frontiers | Practical Implementation of the Kelly Criterion: Optimal Growth Rate, Number of Trades, and Rebalancing Frequency for Equity Portfolios

The efficient frontier for the ten assets with and without short sales... | Download Scientific Diagram